Take Control of Your Finances—The Fun & Fearless Way

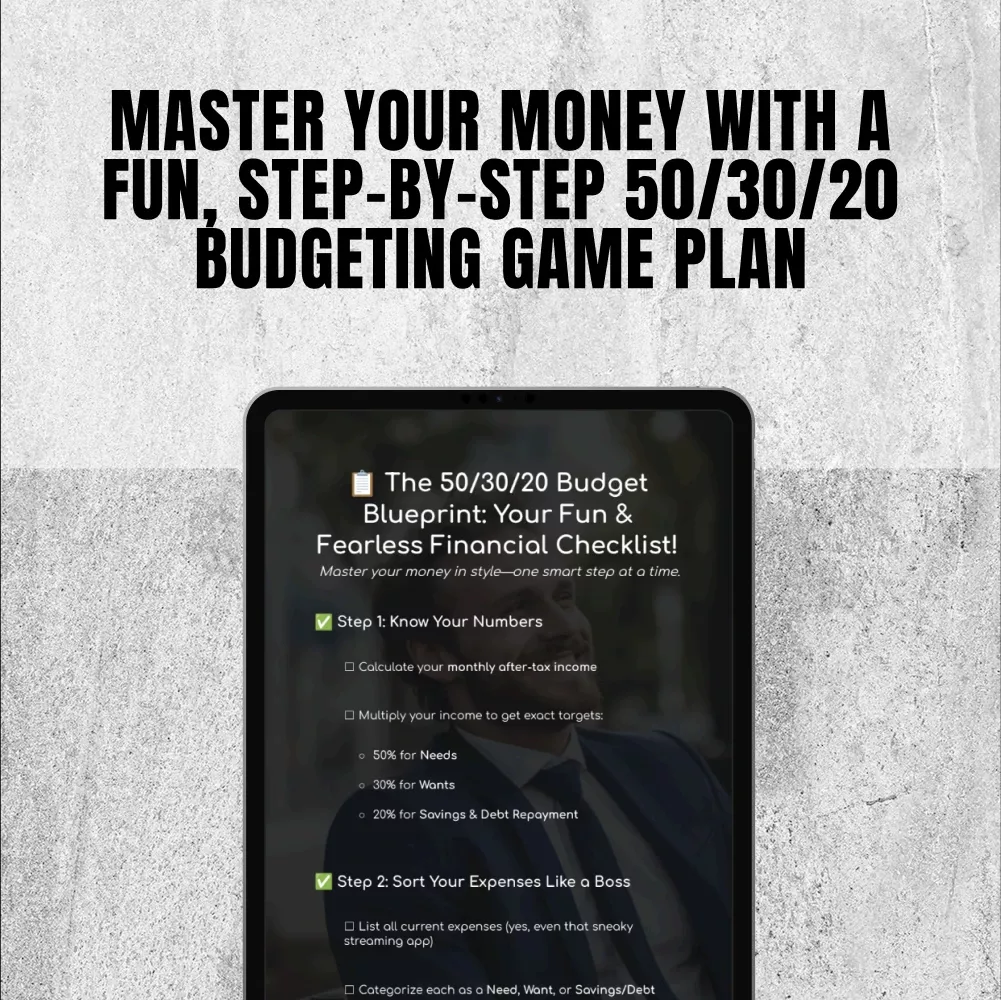

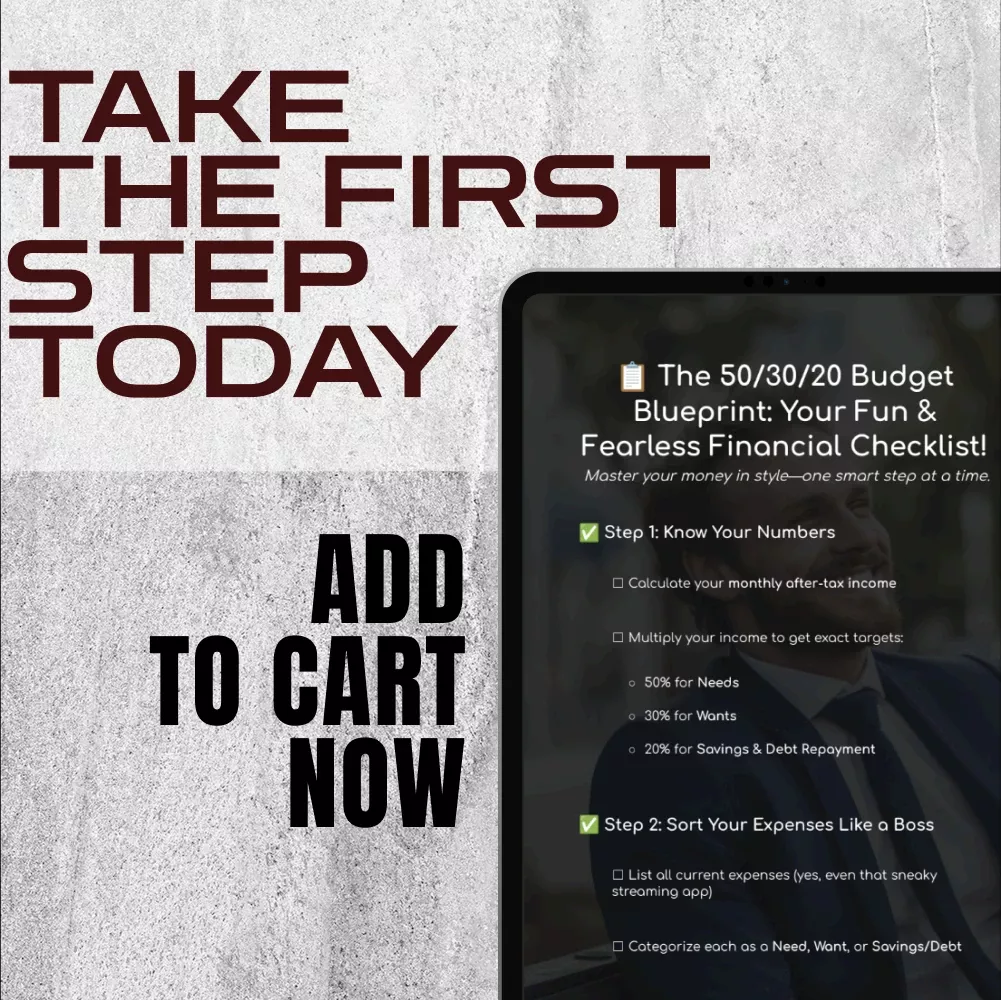

If you’re tired of feeling confused every time you look at your bank account, it’s time to meet your new favorite money tool: The 50/30/20 Budget Blueprint: Your Fun & Fearless Financial Checklist. This easy-to-follow, printable digital checklist takes the stress out of budgeting by walking you through a proven method: the saving money 50 30 20 rule. Whether you’re a budgeting newbie or a financial warrior in need of a reset, this guide helps you get real with your expenses—and finally start saving with confidence.

Designed to be fun, judgment-free, and totally doable, this checklist is your step-by-step action plan to understand your money, make smarter choices, and actually enjoy budgeting (yes, it’s possible!).

What You’ll Get Inside

- Know Your Numbers — Learn how to break down your monthly income using the 50 30 20 budget system

- Sort Your Expenses Like a Boss — Honestly evaluate and categorize every expense

- Trim the Fat (Without Crying) — Spot and cut unnecessary spending without feeling deprived

- Automate Like a Genius — Set up auto-transfers and use smart tools like Mint or YNAB

- Avoid These Facepalm Fails — Common budgeting mistakes to dodge

Why You’ll Love It

- Simple and actionable — No fluff, just steps that work

- Perfect for visual learners — Checklist format keeps you focused

- Budget without guilt — Still have fun while hitting your goals

- Fits any lifestyle — Whether you’re saving for debt repayment, a big goal, or just want peace of mind

Who It’s For

This digital checklist is ideal for anyone looking to take control of their finances without getting overwhelmed. Whether you’re a student, young professional, parent, or side-hustler, the saving money 50 30 20 method will help you make sense of your budget in a way that sticks.

What Makes It Different?

Unlike generic budget templates, this checklist was designed with real people in mind—no finance degree needed. It breaks down every step in plain English, includes a splash of humor to keep you motivated, and focuses on the practical realities of managing money in a digital world.

Ready to Budget Like a Boss?

Download The 50/30/20 Budget Blueprint: Your Fun & Fearless Financial Checklist now and take your first step toward financial freedom. Whether you’re just getting started or looking to upgrade your budget game, this easy and empowering checklist is the tool you’ve been waiting for. Start using the saving money 50 30 20 method today—your bank account will thank you!

How much does shipping cost?

We are glad to bring our customers great value and service. That’s why we provide fast shipping from our Fulfillment Center in California by UPS and USPS.

What countries are you delivering to?

As of now, we’re delivering to the United States only.

How can I track my parcel?

Once your parcel has left our Fulfillment Center, you will receive an email with a tracking number to monitor your parcel movements.

Can you ship my order to a business address?

Yes, you can write your business address in your order details if it’s more convenient to you.

Can you ship my order to a PO Box address?

Yes, you can select delivery to a PO Box if it’s more convenient to you.

Can you ship my order to APO or FPO military addresses?

Yes, we ship anywhere in the United States, and to all US territories and military APO/FPO addresses.

What happens to my parcel if it is delivered while I’m not there?

Depending on the destination and the package size, your parcel will be left in your mailbox or on your porch, or it may be left with a neighbour.

Can I cancel my order?

All orders can be canceled until they are shipped. If your order has been paid and you need to change or cancel it, please contact us within 12 hours of placing it.

Can I get a refund if something is wrong with my order?

Within 14 days of receiving the parcel, you can ask us for:

- A full refund if you don’t receive your order

- A full refund if your order does not arrive within the guaranteed time (1-3 business days not including 1 business day processing time)

- A full or partial refund if the item is not as described

Full refunds are not available under the following circumstances:

- Your order does not arrive due to factors within your control (e.g. providing the wrong shipping address)

- Your order does not arrive due to exceptional circumstances outside our control (e.g. not cleared by customs, delayed by a natural disaster).

All our products are backed with a 14-day money back guarantee. Just send us a message on the Contact Us page and we will refund the purchase price.

Can I return an item for an exchange instead of a refund?

Yes, you can! Kindly Contact Us form to discuss the details with us.

Can I return my purchase?

All our products are backed with a 14-day money back guarantee. Just contact us and we will refund the purchase price.

If you are not satisfied with your purchase, you can return it for a replacement or refund. No questions asked! You only should return it at your expense.

Please contact us first and we will guide you through the steps. We are always ready to give you the best solutions!

Please do not send your purchase back to us unless we authorize you to do so.

Are there any items I can’t return?

Hygiene and our customers’ safety is our top priority, which is why there are specific types of products that can’t be returned such as:

- Face and body products if opened, used, or have a broken protective seal

- Underwear if the hygiene seal is not intact or any labels have been broken

- Swimwear if the hygiene seal is not intact or any labels have been broken

- Pierced jewellery if the seal has been tampered with or is broken

Alright, so let me tell you about this little gem that I've stumbled upon. It’s a budgeting tool that genuinely surprised me—not with flashiness or hype, but with how simply and effectively it helps manage personal finances. If budgeting has ever felt like a confusing chore or something you constantly put off, this tool might be just what you need. 💡 To start with, it's incredibly user-friendly. There's no steep learning curve or overwhelming interface to deal with. Everything is laid out in a way that just makes sense, which is a huge relief when you're dealing with numbers and expenses. Budgeting used to feel like solving a puzzle without all the pieces—but now it’s more like following a clear, straightforward map. What stood out most for me is the practical nature of the tool. It doesn’t make big promises or try to be something it’s not. Instead, it focuses on doing one thing well: helping you stay on top of your money without unnecessary complexity. And it delivers on that front consistently. The simplicity of the design is another big plus. There aren’t dozens of tabs or hidden features to figure out. It’s all right there, which makes it really easy to build a routine around it. I found myself checking in more regularly, not because I had to, but because it felt helpful and empowering. Another thing I’ve appreciated is the time it saves. Instead of spending evenings manually going through receipts or bank statements, I can now just open the app, check my stats, and move on with my day. That kind of ease makes budgeting feel less like a task and more like a habit I’m actually glad to keep. If someone were to ask whether I’d recommend it, my answer would be yes—especially for anyone who wants to get a better grip on their finances without investing a ton of time or energy. It’s not flashy, but it’s dependable and refreshingly no-nonsense. 🙌 All in all, this budgeting tool has made a noticeable difference in how I manage money. It fits seamlessly into daily life, helps build better financial habits, and gives me a clearer picture of where things stand. Definitely a worthwhile addition to any budgeting toolkit.

This budget blueprint has been a godsend. I've always struggled with understanding my finances, but this guide makes it so simple and straightforward. The humor and light-hearted approach make it enjoyable to follow along, which is something I never thought I'd say about budgeting.

Loved the humor in this guide! Made budgeting less boring and more fun.

I came across the 50/30/20 Budget Blueprint while looking for a more approachable way to get serious about my finances—and it turned out to be exactly what I needed. It strikes the right balance between structure and simplicity, offering a budgeting method that feels doable rather than overwhelming. The breakdown—50% for needs, 30% for wants, and 20% for savings or debt—isn’t just easy to understand, it’s also easy to apply. What’s especially helpful is how the Blueprint guides you through each category with clear explanations and real-life examples. It helps you see where your money is going without making you feel guilty about enjoying a little flexibility in your spending. 🧾💡 One of the most refreshing aspects is the tone. This isn't a stiff financial manual—there’s a light touch of humor throughout that keeps things engaging without ever getting in the way of the actual content. That small dose of personality goes a long way in making you feel like you're learning from a friend rather than sitting through a lecture. Another thing I appreciated was how actionable it is. You’re not just reading about budgeting in theory; you're given tools and prompts to start applying the framework right away. Whether you're new to budgeting or just looking for a way to simplify things, the Blueprint offers a realistic approach that you can stick with over time. Since using it, I’ve found it much easier to keep track of my expenses and make intentional decisions about saving and spending. I no longer feel like I’m guessing when it comes to money—I have a clear picture, and that brings a real sense of peace and control. 😊 Overall, the 50/30/20 Budget Blueprint has been a practical and genuinely helpful resource. It doesn’t try to be flashy or overpromise results—it just works. If you’re looking to get a better handle on your personal finances without getting lost in the weeds, I’d say this is well worth your time.

As a student on a tight budget, this checklist has been invaluable in helping me manage my funds effectively. The method taught here is clear-cut yet flexible enough to cater to different lifestyles and income levels. Plus, it's presented in such an engaging manner that even finance novices like myself can easily grasp!

This blueprint has been incredibly helpful to me. I feel like I have control over my finances now.

Saving money used to feel like a chore, but this checklist has flipped that script in the best way. It’s like having a personal finance coach cheering you on while making budgeting surprisingly approachable—and even enjoyable. For the first time, I don’t feel like I’m constantly sacrificing to stay on track. Instead, I’m empowered to cut back on what I don’t need without guilt, all while having more fun with what I do keep. The structure is simple but effective, and it’s helped me actually look forward to planning out my budget. It’s become a tool I genuinely enjoy using each month.

ok

I'm a student and this checklist is perfect for managing my limited funds!

It’s not often that a budgeting guide actually changes the way you think about money—but this one did just that for me. I didn’t expect to come away feeling more in control without feeling restricted, but that’s exactly what happened. Going through the guide helped me recognize how much of my spending wasn’t really adding value to my life, and cutting back didn’t feel like a sacrifice at all. In fact, it felt like clarity. 💸 What I appreciated most was the approach. It isn’t about extreme frugality or making you feel bad for spending—it’s about being more intentional. The guide walks you through practical steps for identifying what matters most to you, and then aligning your budget around that. As a result, I’ve been able to save more while still spending on the things that genuinely bring joy or convenience. The tone of the guide is another big plus. It’s friendly, straightforward, and never condescending. That made it a lot easier to stay engaged and motivated. There’s a clear understanding that personal finance isn’t one-size-fits-all, and the advice reflects that—flexible enough to suit different lifestyles but still structured enough to keep you on track. Since applying what I learned, I’ve noticed real changes. I’m more thoughtful about purchases, less stressed about bills, and my savings have steadily grown. But more importantly, I feel like I’m spending in a way that reflects my values, not just habits. 📈 Overall, this guide has been a practical and eye-opening resource. It helped me shift from mindless spending to mindful decision-making—without any guilt or pressure. If you’re looking to get more from your money without overhauling your entire life, this is a great place to start

No fluff, just practical steps that actually work. Highly recommended!

Even with some experience in personal finance, I found this checklist refreshingly simple and effective. It delivers clear, actionable steps — though I do think a few advanced tips would've added more depth.

This guide made saving money feel achievable.

The 50/30/20 method was new to me but it's made a huge difference.

As someone who’s always felt overwhelmed by budgeting jargon and financial advice that goes over my head, this blueprint was like a breath of fresh air. It breaks everything down into manageable, clear steps that made saving money finally feel within reach. I appreciated how it guided me from square one without making me feel behind or out of my depth. While a few of the later tips felt a bit too introductory, the overall structure gave me the clarity and confidence I was missing. It’s not just informative—it’s motivating, and that’s what really made the difference for me.

Who knew you could still have fun while hitting your financial goals? This guide proves it's possible!

This budget guide is a breath of fresh air. It's not just about crunching numbers, it’s about understanding your spending habits and making smarter choices. The 50/30/20 method has been an eye-opener for me; I never realized how much I was overspending on non-essentials! Highly recommended.

Being able to automate some aspects of my finances using tips from this guide has saved me time as well as stress over forgetting bills or payments - something we could all do with less of these days!

Recommend

i've tried other methods before but nothing stuck until i found this checklist

This financial checklist is perfect for visual learners – everything is laid out clearly making it easier to stay focused on your goals!

A budgeting tool that's actually fun to use!

I used to avoid budgeting like the plague because it always felt like an intimidating, joyless task—but this checklist completely flipped that experience for me. It’s straightforward without being dry, and the little touches of humor made the whole process feel way more approachable and less like a lecture. I found myself actually enjoying the act of reviewing my spending and planning ahead, which I never thought I’d say. While it nails the basics and makes day-to-day budgeting feel doable, I do wish it had gone a bit deeper into strategies for long-term goals. Still, it’s a solid starting point that’s helped me build momentum and feel more in control of my money.

Saving money has never been easier or more enjoyable thanks to this fearless financial checklist!

As someone who used to dread looking at my bank account every month, this guide has completely changed my perspective on money management. Not only does it provide practical tips and strategies but also encourages you to have fun while doing so.